Accurate and timely payroll is essential for employee satisfaction and business success. Employees are more motivated when they receive their wages on time and in the correct amount. Unfortunately, many businesses still struggle with effective payroll management. As of 2021, only 67% of companies had a formal payroll strategy in place (EY Global Payroll Survey, 2021).

Small business payroll management can be especially challenging today, given the rise of flexible hours and remote work. Companies face difficulties in keeping employees engaged while ensuring compliance with regulations. This is where payroll software comes in, helping businesses streamline payroll processes and ensure accuracy. In this guide, we’ll explore the best payroll software on the market, highlighting their key features and pricing, so you can find the right fit for your needs.

Payroll Software Trends

With the global shift toward digital and cloud technologies, the payroll software market is experiencing significant growth. According to Market Research Future (2022), the HR payroll software market is projected to reach $15.37 billion by 2030, growing at a CAGR of 11.2%. Businesses are increasingly adopting self-service, cloud-based payroll software, enabling them to handle payroll functions independently.

Payroll software is not just a tool for calculating wages anymore; it’s an essential business solution. Key payroll software trends include:

- Global Standardization: Companies are seeking ways to standardize payroll operations across borders to simplify compliance and reporting.

- Complex Compliance Needs: Compliance with tax laws and regulations is becoming more complicated, especially with hybrid and remote teams working across different jurisdictions.

- AI and Automation: The integration of artificial intelligence (AI) and robotic process automation (RPA) is helping businesses eliminate errors and streamline payroll operations.

- Faster Payroll Processing: Payroll software is enabling businesses to process payroll faster, improving employee experience and reducing errors.

Choosing Payroll Software for Remote Teams

Managing payroll for remote teams presents unique challenges. When selecting payroll software for a remote workforce, consider the following features:

- Global Compliance Capabilities: Ensure the software can handle local tax laws, currency conversions, and payroll regulations in multiple regions.

- Time Tracking Integration: Remote workers often work across different time zones. Payroll software should integrate time tracking systems to ensure accurate payroll calculations.

- Automated Payments: The software should support automated payments in multiple currencies to avoid delays or errors when paying remote employees.

- Data Security: Given the sensitivity of payroll data, ensure the software uses encryption, multi-factor authentication, and customizable access controls.

- Self-Service Portals: Remote employees should have access to self-service portals to view their pay stubs, update personal information, and track tax details.

Top Payroll Software Solutions

Here are some of the best payroll software solutions available:

1. RUN Powered by ADP

RUN Powered by ADP is a comprehensive payroll and HR platform designed specifically for small businesses. It offers tools for recurring payroll, tax filing, and built-in payment options, making it easy to manage payroll from anywhere.

Key Features:

- Payroll processing can be done from any device, anywhere.

- Automatic tax computation and payment.

- Automated submission of quarterly and annual reports.

- Seamless integration with timekeeping systems.

- 24/7 payroll support.

Pricing: Starting at $79 per month, plus $4 per employee.

2. Paylocity

Paylocity is an all-in-one platform for managing payroll, benefits, talent, and workforce tasks. It is particularly suitable for small businesses, with customizable features for reports, accruals, and payroll management.

Key Features:

- Flexible user interface to streamline onboarding.

- Integrates payroll with HR functions.

- Scalable for businesses of all sizes.

- Employee self-service options.

- Built-in tax preparation module.

Pricing: Available upon request.

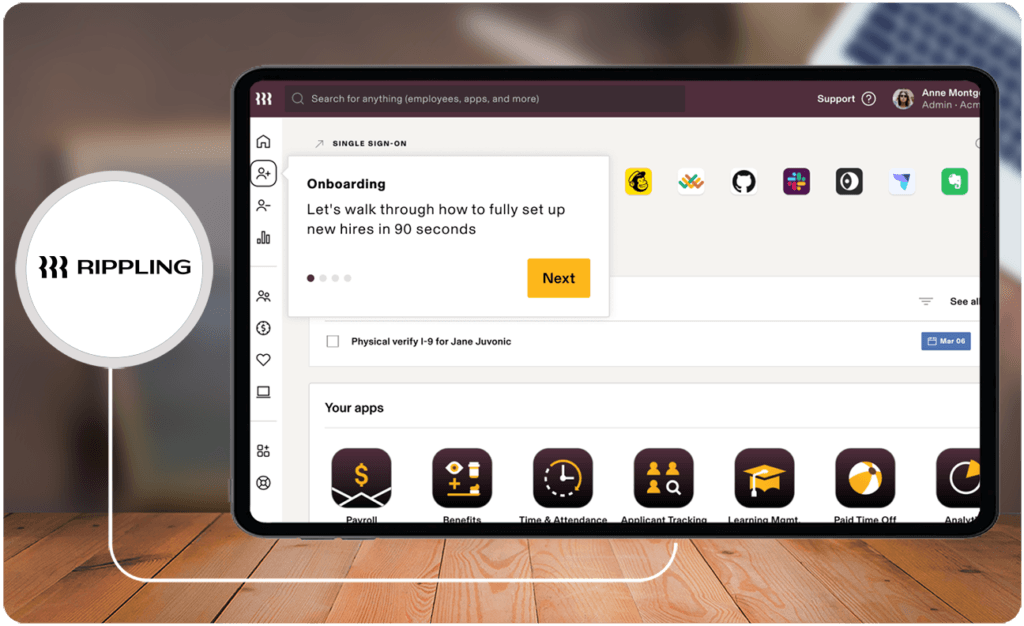

3. Rippling

Rippling consolidates payroll and HR functions into one platform. It supports global payroll processing, allowing businesses to pay employees worldwide in minutes. The platform also integrates with hundreds of other business tools for seamless payroll management.

Key Features:

- Over 500 integrations with other business systems.

- Automatic tax filing at federal, state, and local levels.

- Mobile app for easy employee access to HR data.

- Strong data protection to ensure confidentiality.

- Reporting and analytics tools for decision-making.

Pricing: Starts at $8 per user, with additional fees depending on requirements.

Payroll Software Statistics

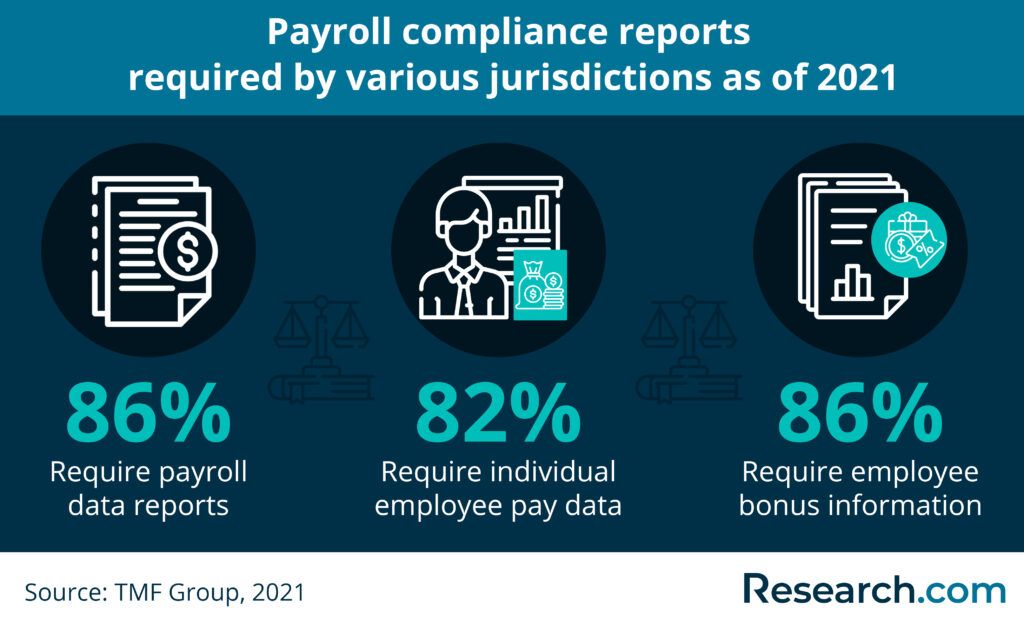

Understanding payroll software statistics can provide insight into current trends and challenges. According to Deloitte (2020), 74% of companies are already using cloud-based payroll technology, and 59% are considering implementing automation to increase payroll efficiency.

- 68% of global businesses cite compliance as a major payroll challenge.

- 48% of payroll errors are attributed to HR data input mistakes.

- 53% of global companies manage payroll from a central location.

- 73% outsource some payroll tasks to third-party providers.

These statistics show the importance of using advanced payroll software to reduce errors, ensure compliance, and streamline operations.

The Future of Payroll Software

As the payroll function continues to evolve, payroll software will play a key role in helping businesses stay competitive. The future of payroll software includes:

- Global Payroll Solutions: As more companies expand internationally, global payroll solutions will become essential for managing multi-country payroll compliance and reporting.

- Automation and AI: The use of AI and automation will continue to grow, improving accuracy and efficiency in payroll processing.

- Employee Experience: Payroll software will increasingly focus on enhancing the employee experience by offering faster payments, self-service features, and streamlined processes.

Conclusion

Choosing the best payroll software is essential for businesses looking to optimize their payroll operations and improve compliance. Whether you’re managing payroll for a small team or a global workforce, the right software can help reduce errors, save time, and improve the overall employee experience.

Consider your business’s specific needs, such as global compliance, remote work integration, and automation, when selecting payroll software. By choosing a solution that offers the right features at an affordable price, you can ensure that your payroll processes run smoothly, allowing you to focus on growing your business.